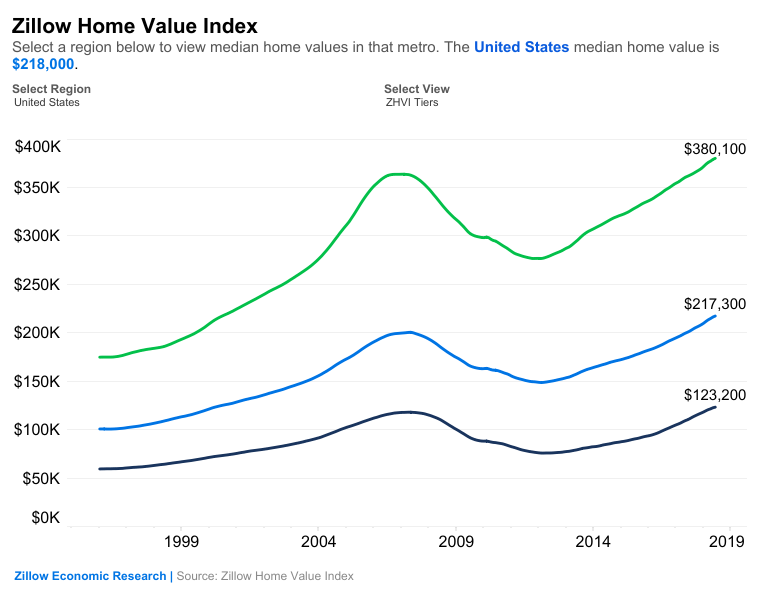

Median home values increased 8 percent year-over-year, to $218,000 in July, but in 20 of the 35 largest markets growth slowed modestly, according to a market analysis by Zillow released Thursday.

The slowdown was most prevalent in Seattle, Tampa, Sacramento, Calif., and Portland, Ore, the four hottest markets over the past year. In Seattle, home-value growth declined from 14.8 percent in June 2017 to 9.1 percent this July.

In Tampa, home-value growth slowed to 10.6 percent, while in Sacramento, and Portland, it clocked in at 5.7 percent.

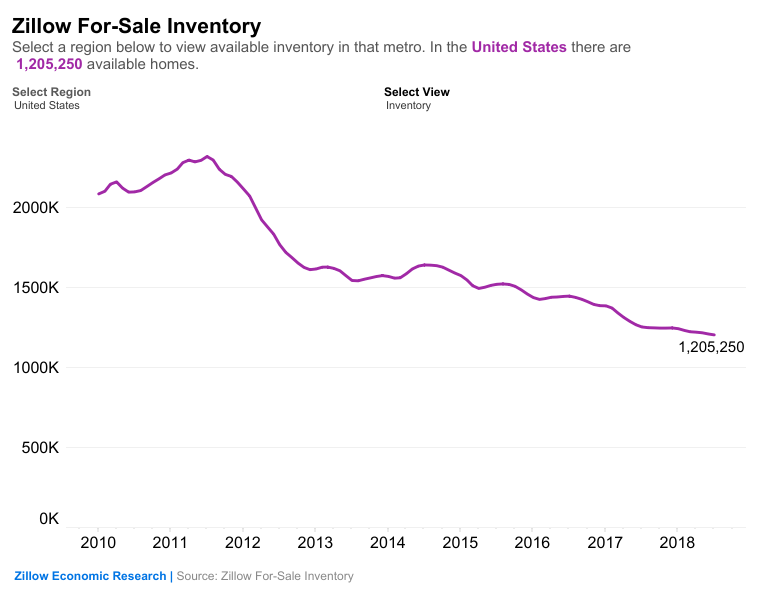

Zillow says the slowdown is due to a slight uptick in inventory in 19 of the 35 largest markets, with the largest inventory gains happening in some of the most expensive markets, such as Seattle (+13.2%), San Jose (+46.2%), and San Diego (+36.3%).

How TorchX helps brokerages centralize and automate digital marketing for their agents

One platform to generate, convert and nurture real estate leads READ MORE

Nationwide, inventory remains low at 3.9 percent year-over-year, and Zillow this week projected it will be at least two years before the market favors buyers.

“Home values are still growing faster in most major markets than they did historically, one reason it’s too soon to call it a buyer’s market,” according to the report. “Lower-valued homes also continue brisk gains: Homes valued in the lower third nationally rose 10.9 percent in value year-over-year, while homes valued in the top third rose at less than half that, at 4.9 percent.”

Like the for-sale market, the rental market experienced slower rent growth compared to last year. In July, median rent grew 0.5 percent year-over-year to $1,440 per month, a 1.1 percent decrease from 2017. Seattle (-5%), Portland (-0.7%), and Kansas City (-1%) had the largest declines on an annualized basis.

Meanwhile, the median rent in Riverside, Calif. increased 4.6 percent year-over-year to $1,898 — the biggest increase among the 35 largest markets included in the analysis. Sacramento and Las Vegas trailed closely behind with increases of 4.4 percent and 3.2 percent, respectively.

Home-values continued to rise in July, but at slower rate: Zillow curated from Inman – Real Estate News for Realtors and Brokers

Comments

Post a Comment