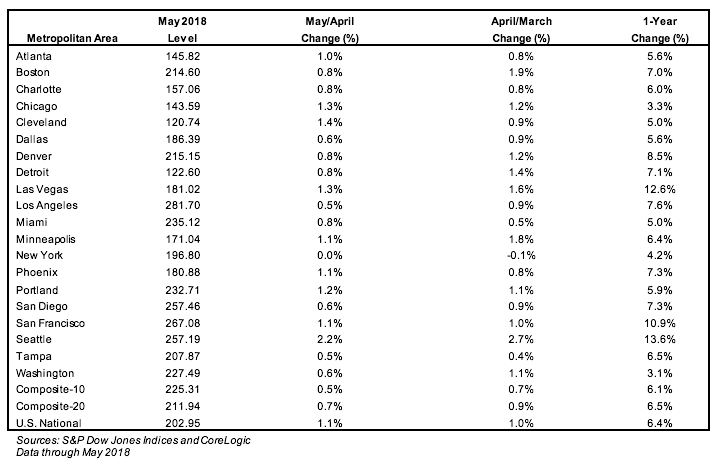

Annual home price growth was flat in May 2018, unchanged from the April’s 6.4 percent, according to the latest S&P CoreLogic Case-Shiller National Home Price NSA Index, announced Tuesday — one of the industry’s most trusted metrics.

Also, the month-over-month growth from April 2018 to May 2018 was only 0.4 percent, seasonally adjusted.

The good news for buyers: the rate at which home prices are rising, year-over-year and month-over-month, seems to have largely stabilized, for now. The bad news: homes are not getting any cheaper, anytime soon.

“Not only are prices rising consistently, they are doing so across the country,” said David Blitzer, Managing Director & Chairman of the Index Committee at S&P Dow Jones Indices in a press release.

Once again, Seattle, Las Vegas, and San Francisco reported the highest year-over-year gains, according to the report. Seattle had the strongest gains with a 13.6 percent year-over-year increase, followed by Las Vegas at 12.6 percent and San Francisco at 10.9 percent.

Capture and nurture leads with Placester’s integrated marketing platform

Stand out online and win more business with a unified set of marketing tools READ MORE

“Home prices continue to rack up gains two to three times greater than the inflation rate,” said Blitzer. “The year-over-year increases in the S&P CoreLogic Case-Shiller National Index have topped 5 percent every month since August 2016.”

“Continuing price increases appear to be affecting other housing statistics. Sales of existing single-family homes – the market covered by the S&P CoreLogic Case-Shiller Indices – peaked last November and have declined for three months in a row,” he added. “The number of pending home sales is drifting lower as is the number of existing homes for sale. Sales of new homes are also down and housing starts are flattening.”

“Affordability – a measure based on income, mortgage rates and home prices – has gotten consistently worse over the last 18 months. All these indicators suggest that the combination of rising home prices and rising mortgage rates are beginning to affect the housing market.”

Realtor.com chief economist Danielle Hale says sellers are increasing their asking prices, which hints at their confidence that buyers will pony up the extra cash rather than wait for a more affordable option. But like Blitzer, Hale thinks existing-home sales data shows that buyers are doing the opposite of what sellers expect.

“Home buyers out West drove home prices even higher in May, with Seattle, Las Vegas, and San Francisco leading the charge,” Hale said in an emailed statement. “Asking prices of for-sale homes increased 8 percent in May and have maintained that pace in recent months according to realtor.com data, suggesting that in most markets home-sellers believe buyers are willing to pay up.”

“Sales prices and volumes will ultimately reveal whether sellers are correct,” she added. “In the first half of the year, survey data indicate that only 28 percent of successful home buyers paid less than asking price, but at the same time, existing home sales have slowed, suggesting that some buyers are watching instead of diving in.”

“Unlike the boom-bust period surrounding the financial crisis, price gains are consistent across the 20 cities tracked in the release; currently, the range of the largest to smallest price change is 10 percentage points compared to a 20 percentage point range since 2001, and a 25 percentage point range between 2006 and 2009,” added Blitzer.

Home price growth remains high but stable at 6.4 percent curated from Inman

Comments

Post a Comment