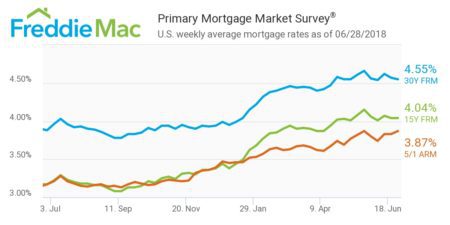

Freddie Mac today released its latest Primary Mortgage Market Survey (PMMS) results, which revealed that mortgage rates have dropped 0.2 percentage points week-over-week to 4.55 percent — the fourth decline in the past five weeks.

Freddie Mac chief economist Sam Khater says mortgage rates have stabilized over the past two months, a piece of good news for buyers who still have to grapple with exorbitant home price growth.

“The decrease in borrowing costs are a nice slice of relief for prospective buyers looking to get into the market this summer,” Khater said in a press release.

“Some are undoubtedly feeling the affordability hit from swift price appreciation and mortgage rates that are still 67 basis points higher than this week a year ago.”

Realtor.com chief economist Danielle Hale also offered commentary on today’s report, saying although short-term rates have steadily risen, the lack of growth in longer-term bond rates has kept mortgage rates steady.

How to rope in more seller leads with Mega Agent Pro

Outsource seller prospecting and focus on what you do best READ MORE

“After nearing 3 percent just two weeks ago, 10-year treasury rates finished yesterday 15 basis points lower at 2.83 percent,” said Hale in an emailed statement.

“This has helped keep mortgage rates, which are more closely aligned to longer-term 10-year rates, roughly steady. In fact, Freddie Mac data today showed a slight decline to 4.55 percent, from 4.57 percent last week.”

Much like Khater, Hale says buyers should enjoy these declining mortgage rates. But, she said buyers need to be cognizant of future hikes and keep the full picture in mind.

“Mortgage rates could continue to move lower if concern that tariffs will hamper economic activity persists,” she said. “However, continued evidence of strength in the U.S. economy, like we might see in next week’s jobs report, could cause treasury rates to resume climbing. If so, it wouldn’t be long before mortgage rates followed back up.”

“Home shoppers should enjoy these slightly lower moves, but be aware that rates are still 67 basis points higher than one year ago,” Hale concluded. “Coupled with listing prices that are 9 percent higher year-over-year, monthly payments for principal and interest alone are 18 percent higher on the typical home listing.”

Buyers should take advantage of mortgage rate decline curated from Inman

Comments

Post a Comment