One out of every 10 millennials sold cryptocurrency to save for their first home.

Redfin released a new survey exploring how millennials between the ages of 24 and 38 saved for homes. The sale of cryptocurrency, a virtual currency and medium of exchange, was named by 10 percent of millennials as their means to afford an initial down payment on a primary home over the next year, according to the survey, released Thursday.

Courtesy fo Redfin

Digital currencies, the most popular and reputable of which remain Bitcoin and Ethereum but also include numerous cryptocurrencies backed by real estate assets, experienced a leap in value last year. While these investment remains high-risk, new startups are seeking people to put money into cryptocurrencies and the blockchain technologies behind them.

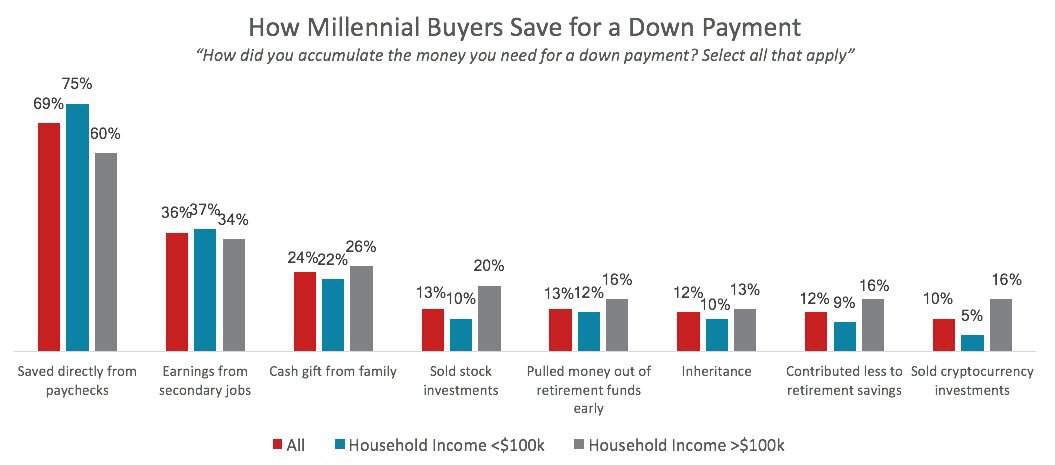

Nonetheless, a majority of millennials still saved for their first home the traditional way — 69 percent put aside portions of a paycheck each month; 36 percent added earnings from a secondary job; and 24 percent received cash from family.

Along with cryptocurrency, four other less popular ways of saving included selling stocks (13 percent), pulling money out of retirement funds early (13 percent), inheritances (12 percent) and contributing less to retirement funds (12 percent).

How to rope in more seller leads with Mega Agent Pro

Outsource seller prospecting and focus on what you do best READ MORE

However, once these saving were analyzed by income level, Redfin discovered larger discrepancies: only 60 percent of those who earned more than $100,000 a year could afford to stash away savings from their paycheck and were instead forced to pull money out of retirement funds or other means, Redfin Senior Economist Sheharyar Bokhari said.

“These results reveal some of the inequalities that have been exacerbated in the years following the recession, with the well-off having more flexibility and thereby ability to become homeowners and build more wealth, through advantages like financial support from family and the opportunity to invest in the stock market,” Bokhari said in a statement.

1 out of 10 millennials are selling cryptocurrency to save for first home curated from Inman

Comments

Post a Comment