We’ll add more market news briefs throughout the day. Check back to read the latest.

Most recent market news

Friday, April 27

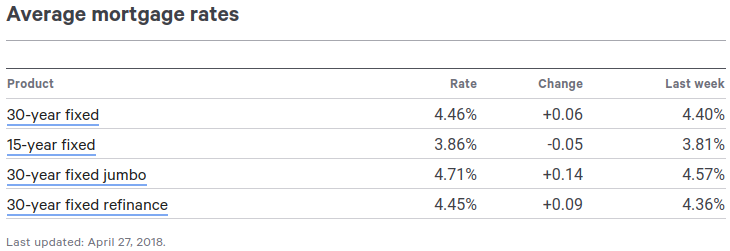

- The average rate for the benchmark 30-year fixed mortgage is 4.46 percent, up 6 basis points over the last week. A month ago, the average rate on a 30-year fixed mortgage was lower, at 4.27 percent.

- The average 15-year fixed-mortgage rate is 3.86 percent, up 5 basis points over the last week.

Source: Bankrate

News from earlier this week

Thursday, April 26

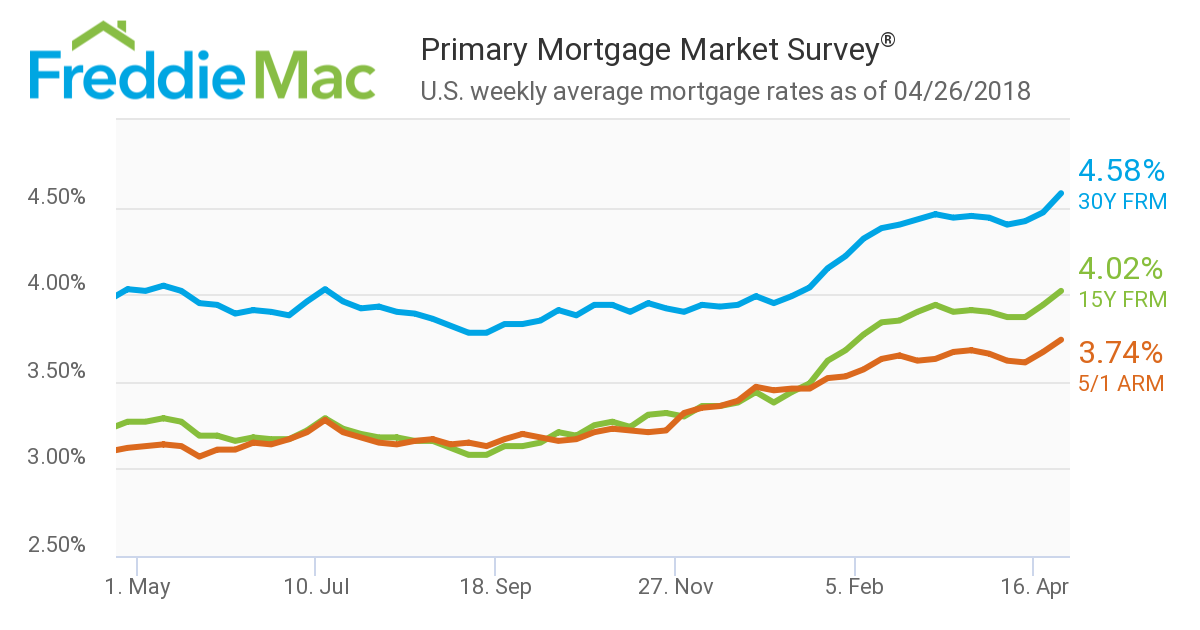

Freddie Mac Primary Mortgage Survey

How to win in the lucrative global real estate market

3 ways real estate agents can capture and close international deals READ MORE

- 30-year fixed-rate mortgage (FRM) averaged 4.58 percent with an average 0.5 point for the week ending April 26, 2018, up from last week when it averaged 4.47 percent. A year ago at this time, the 30-year FRM averaged 4.03 percent.

- 15-year FRM this week averaged 4.02 percent with an average 0.4 point, up from last week when it averaged 3.94 percent. A year ago at this time, the 15-year FRM averaged 3.27 percent.

- 5-year Treasury-indexed hybrid adjustable-rate mortgage (ARM) averaged 3.74 percent this week with an average 0.3 point, up from last week when it averaged 3.67 percent. A year ago at this time, the 5-year ARM averaged 3.12 percent.

“Following Treasuries, mortgage rates soared,” said Len Kiefer, Freddie Mac deputy chief economist. “The U.S. weekly average 30-year fixed mortgage rate rose five basis points to 4.47% in this week’s survey, its highest level since January of 2014 and the largest weekly increase since February of this year.”

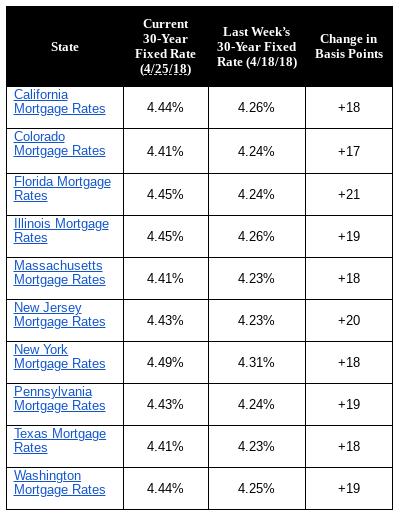

- The 30-year fixed mortgage rate on Zillow Mortgages is currently 4.43 percent, up 18 basis points from this time last week.

- The 30-year fixed mortgage rate climbed steadily over the past week.

- The rate for a 15-year fixed home loan is currently 3.83 percent, and the rate for a 5-1 adjustable-rate mortgage (ARM) is 3.78 percent.

- The rate for a jumbo 30-year fixed loan is 4.47 percent.

Source: Zillow

“After flatlining for much of the past two months, mortgage rates have again moved definitively upward, touching their highest levels since January 2014,” said Aaron Terrazas, senior economist at Zillow.

“This upward momentum suggests a growing acceptance of the underlying strength of the American economy that markets seemed to discount over the past couple of months. Several Fed speakers over the past week noted the strength of incoming U.S. economic data, which will be particularly important going into next week’s FOMC meeting. GDP and wage data due later this week will be important metrics to watch as recent geopolitical flashpoints seem to be receding.”

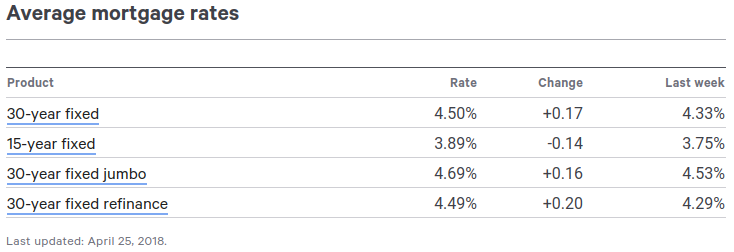

Wednesday, April 25

- The average rate you’ll pay for a 30-year fixed mortgage is 4.50 percent, up 17 basis points since the same time last week. A month ago, the average rate on a 30-year fixed mortgage was lower, at 4.30 percent.

- The average 15-year fixed-mortgage rate is 3.89 percent, up 14 basis points from a week ago.

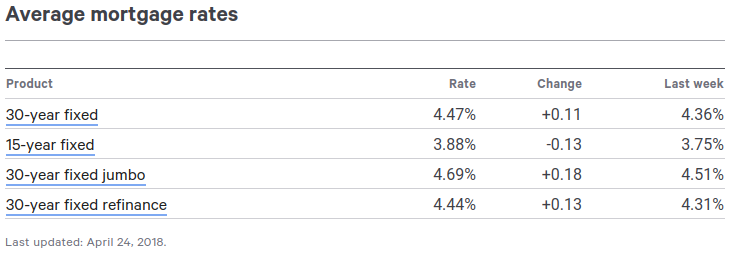

Tuesday, April 24

- The average 30-year fixed-mortgage rate is 4.47 percent, an increase of 11 basis points over the last seven days. A month ago, the average rate on a 30-year fixed mortgage was lower, at 4.33 percent.

- The average 15-year fixed-mortgage rate is 3.88 percent, up 13 basis points over the last week.

Source: Bankrate

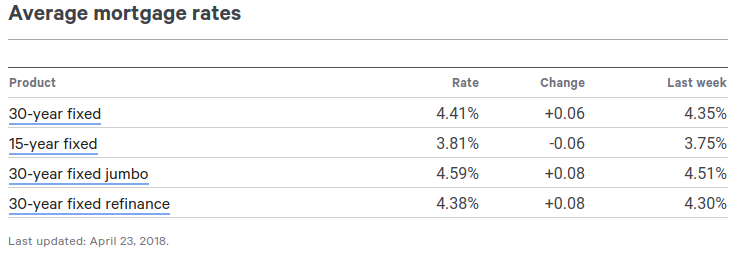

Monday, April 23

- The average 30-year fixed-mortgage rate is 4.41 percent, up 6 basis points since the same time last week. A month ago, the average rate on a 30-year fixed mortgage was lower, at 4.33 percent.

- The average 15-year fixed-mortgage rate is 3.81 percent, up 6 basis points over the last week.

Source: Bankrate

Real estate daily market update: April 27, 2018 curated from Inman

Comments

Post a Comment