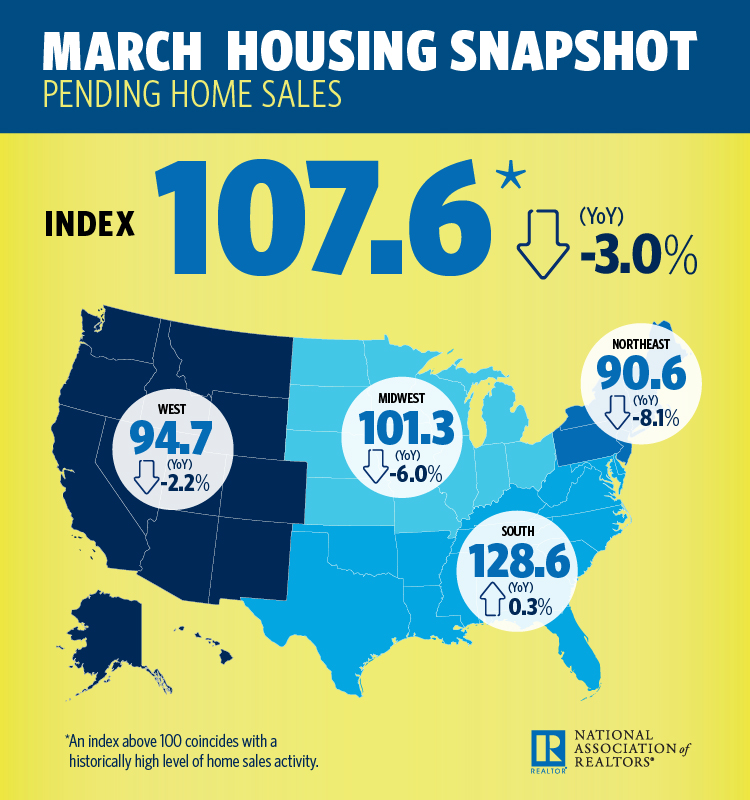

The National Association of Realtors (NAR) Pending Home Sales Index (PHSI), a forward-looking indicator that tracks home sales in which a contract is signed but the sale has not yet closed, increased 0.4 percent in the month of March to 107.6, up from a downwardly revised 107.2 in February.

NAR chief economist Lawrence Yun said low inventory is to blame for the small increases over the past few months. Pending home sales, he said, could be more robust if buyers had the supply to meet their demand.

Healthy economic conditions are creating considerable demand for purchasing a home, but not all buyers are able to sign contracts because of the lack of choices in inventory,” Yun said in a statement.

“Steady price growth and the swift pace listings are coming off the market are proof that more supply is needed to fully satisfy demand. What continues to hold back sales is the fact that prospective buyers are increasingly having difficulty finding an affordable home to buy.”

Despite the month-over-month increase, March’s PHSI is 3.0 percent lower than last year — the third consecutive month of such declines. Looking forward, Yun predicts 2018 existing-home sales to be around 5.61 million — up from 5.51 million in 2017. The national median existing-home price is expected to increase around 4.4 percent.

Monetize more referrals and leads with ReferralExchange

Contact-to-close support for referrals with vetted agents across the US READ MORE

As the housing market moves into the active spring and summer homebuying season, Yun says many buyers will be thwarted by booming home prices and rising mortgage interest rates.

“Much of the country is enjoying a thriving job market, but buying a home is becoming more expensive,” he said. “That is why it is an absolute necessity for there to be a large increase in new and existing homes available for sale in coming months to moderate home price growth.”

“Otherwise, sales will remain stuck in this holding pattern and a growing share of would-be buyers — especially first-time buyers — will be left on the sidelines.”

Here’s the regional breakdown, straight from the report:

- The PHSI in the Northeast fell 5.6 percent to 90.6 in March, and is now 8.1 percent below a year ago.

- In the Midwest the index rose 2.4 percent to 101.3 in March, but is 6.0 percent lower than March 2017.

- Pending home sales in the South climbed 2.5 percent to an index of 128.6 in March, and are 0.3 percent higher than last March.

- The index in the West declined 1.1 percent in March to 94.7, and is 2.2 percent below a year ago.

NAR uses a large national sample of signed residential property sale contracts to build its monthly pending home sales index. The sample size typically represents about 20 percent of transactions for existing-home sales.

The index level was benchmarked to 100 in 2001, which was the first year to be examined. Existing-home sales in 2001 were in the 5 million to 5.5 million range, which is considered normal for the population in the U.S.

March pending home sales inch up by 0.4% curated from Inman

Comments

Post a Comment