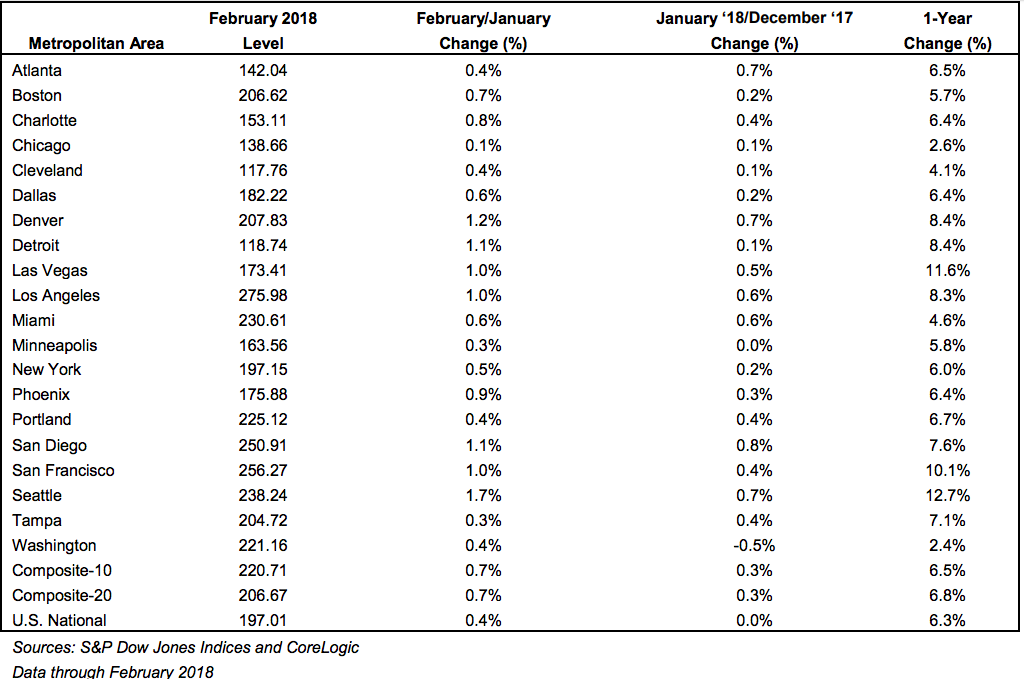

Single-family listings are at all-time highs in 10 of the 20 the regions tracked on this month’s S&P CoreLogic Case Shiller home price index numbers.

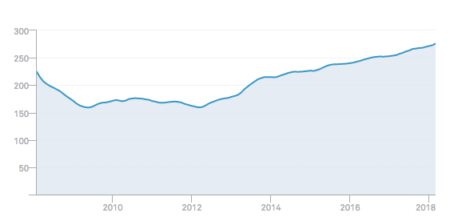

Bespoke Investment first pointed out the milestone over at the financial blog Seeking Alpha. The index as a whole showed a 6.3 percent year-over-year gain for home prices in February, released earlier this week. Home prices, according to the index, showed no sign of slowing and were similar to rising home prices in the 15 years before the financial crisis.

When you break those numbers down from the national to the regional level, the all-time highs are now standing in half of the real estate markets–reaching or exceeding levels seen before 2008.

San Diego and Los Angeles are now at all-time highs. Los Angeles saw a 1.03 percent monthly change and a 8.3 percent year-over-year change, while San Diego saw a 1.11 percent monthly and 7.6 percent year-over-year jump.

Home prices in Los Angeles. Credit: Screenshot of CoreLogic S&P Case Shiller Home Price Index

Many of the cities covered by the index had previously already reached all-time highs post-recession. The addition of Los Angeles and San Diego is enough to ensure that now more than half are at all-time highs.

If it were only about the money, every agent would always be with the lowest cost brokerage

The relationship an agent has with their firm and with the leader makes the difference READ MORE

Atlanta, Boston, Charlotte, Dallas, Denver, Portland, Oregon, San Francisco and Seattle are also at all-time highs.

Chicago, Cleveland, Detroit, Las Vegas, Miami, Minneapolis, New York, Phoenix, Tampa and Washington, D.C. are not.

The S&P CoreLogic Case-Shiller U.S. National Home Price Index is a composite of single-family home price indices that is calculated every month. The indices are calculated using estimates of the aggregate value of single-family housing stock.

Half the cities on Case-Shiller are seeing all-time high home prices curated from Inman

Comments

Post a Comment